How to use Contract Gird Trading?

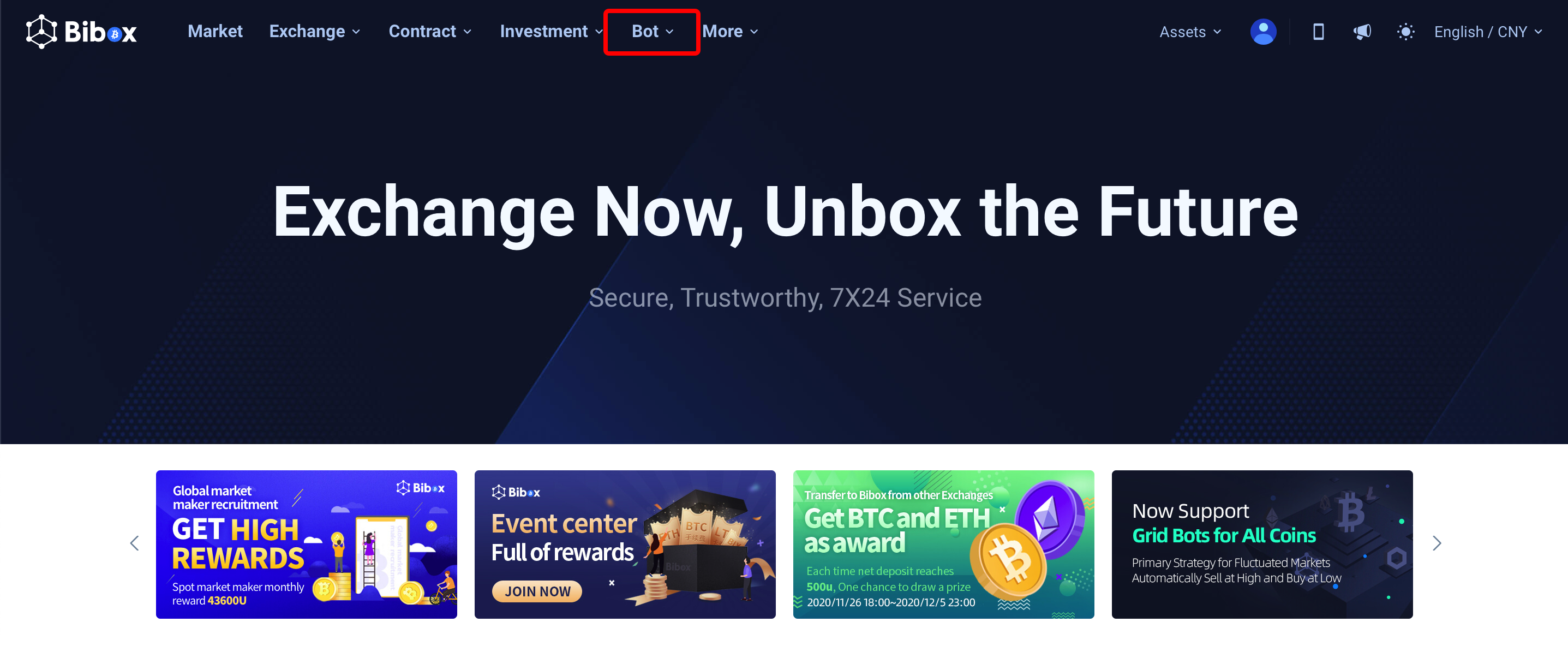

1, Enter Bibox official website and click Bot page

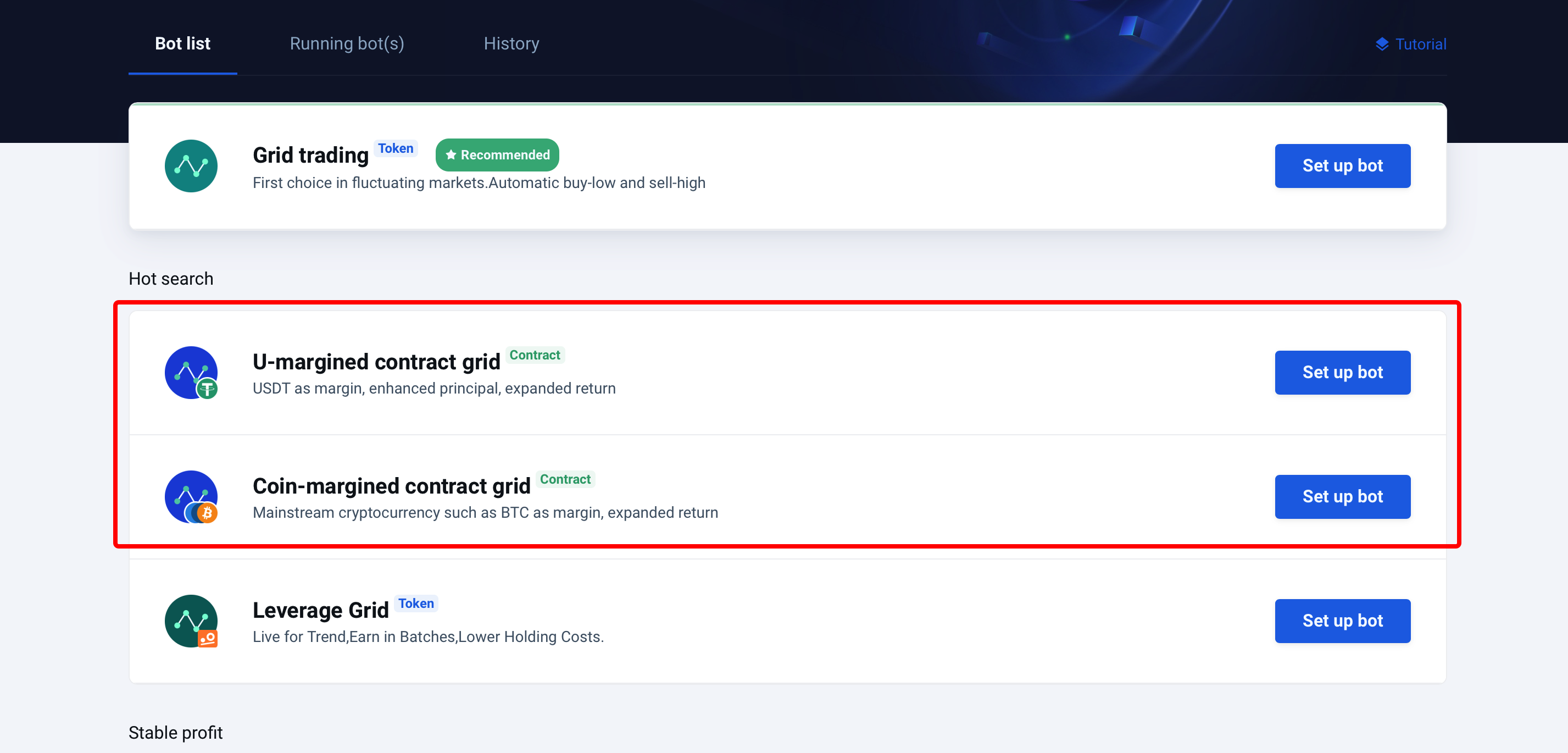

2, Choose Contract Grid and click set up

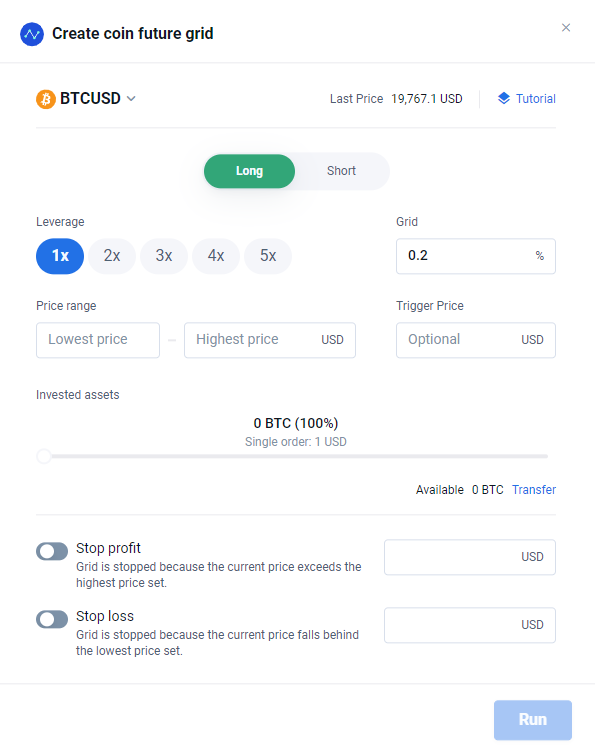

3, Set the parameters in the pop-up window and click confirm to run the contract grid.

4, After setting it up, you can view the grid details at “Running bots” – “Contract Grid”

Terminology:

Position: the price direction you predict that will happen in the near future.

Long: To hold long position(s); Buy/long in the dip and sell/short at the top.

Short: To hold short position(s); Sell/short when the price is rising

Leverage:If you invest 100USDT and choose to leverage it 5 times, it means there will be 500 USDT assets running in your contract grid.

Price range: The price range, within which the contract grid runs. Within the price range set, the program automatically buys low and sells high. On the other hand, Contract Grid will stop when it is beyond the price range

Grid: If you want to open position(s) when there is a 10% price discrepancy, you need to enter 10. Usually, it should be more than 2 times the Maker fee rate.

Invested assets: the assets you use to run grid trading.

Stop profit/loss: A setting that will stop your running grid when the contract profit/loss reaches your setting.

--------

You can also contact Bibox telegram admin (@bibox_cs) or join the Telegram group (https://t.me/bibox_trading_bot) for more details.